The Resolution Council (‘the Council’) was established on 1 January 2015 as the national resolution authority in the Slovak Republic. The institutions that fall within the competence of the Council are credit institutions and those investment firms with share capital of at least € 750,000.

With effect from August 12, 2022, the Council also acts as a national resolution authority for central counterparties.

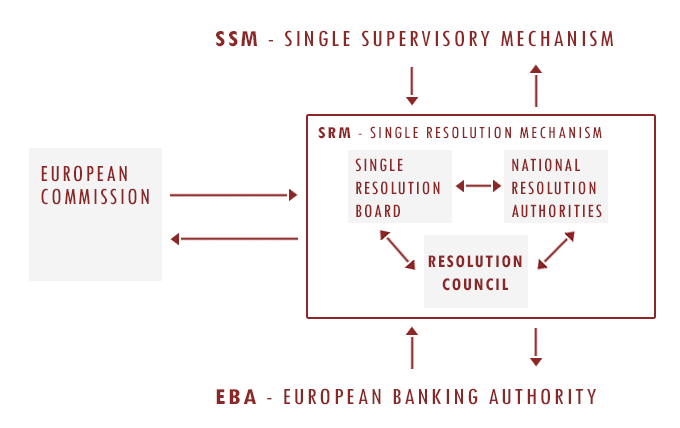

The Council is part of the Single Resolution Mechanism (SRM), which comprises:

- the Single Resolution Board, based in Brussels,

- the national resolution authorities of the euro area countries,

- the national resolution authorities of those other EU Member States that have opted to participate in the SRM.

The main objective of the Council is to prevent the failure of institutions and groups in the financial sector and, if failure cannot be avoided, to ensure their effective resolution, having regard to the preservation of financial stability and the protection of client assets of the given institution or group. It is therefore the Council’s task:

- to draw up resolution plans for institutions incorporated in Slovakia and to contribute to the drafting of resolution plans for groups that have a subsidiary incorporated in Slovakia,

- to comment on recovery plans of those institutions or groups,

- to assess the resolvability of institutions,

- to set minimum requirements for own funds and eligible liabilities (MREL) for individual institutions incorporated in Slovakia,

- to issue decisions under specific regulations in relation to institutions incorporated in Slovakia,

- to perform other activities relating to its participation in the SRM.

The Council was established as an independent public legal entity. It is composed of ten members. The task of providing expertise to, and organising the functioning of, the Council is performed by Národná banka Slovenska.

Single Resolution Mechanism

The establishment of a resolution framework within the EU is a consequence of the global financial crisis, which exposed regulatory and coordination shortcomings in dealing with troubled banks and financial institutions in the EU. In many cases such banks and institutions were bailed out with public money, in order to ensure the stability of the financial system, to protect deposits, and to prevent a further downturn in the real economy.

Decisions of the Single Resolution Board (SRB)